A price war has broken out in the home loans market, with banks correcting their spreads to effective interest rates not seen for more than a year.

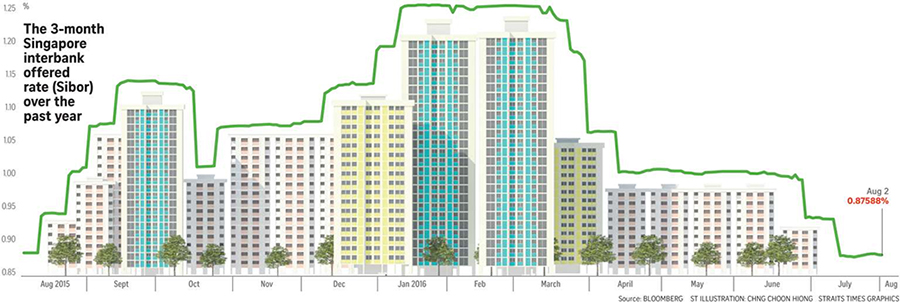

This comes as interest rates in Singapore pulled back recently, as expectations for rate hikes by the US Federal Reserve dissipate.

"We started the year with markets expecting four rate hikes but expectations are now down to only one rate hike this year," said Mr Edward Lee, Standard Chartered head of Asean economic research.

And on the back of a drop in Sibor (Singapore interbank offered rate), used to set many home loans, and in the swap offer rate or SOR, used to price commercial loans, a few banks cut their home loan rates in June, noted Mr Keff Hui, a broker at Mortgage Supermart Singapore. "Other competitor banks swiftly followed suit and introduced new promotional rates to match," he said.

The difference can be marked. Take a person borrowing $800,000 over 25 years. In May last year, some banks were offering one-month Sibor (0.76 per cent) with a margin of 0.85 per cent - effectively about 1.6 per cent - working out to a monthly payment of $3,238, said FindaHomeLoan founder Sean Lim, who is also head of mortgage at financial products portal iMoney.sg.

Now, some banks are offering one-month Sibor (0.63 per cent) with margin of 0.65 per cent - effectively 1.28 per cent - working out to a monthly payment of $3,118.

"Sibor-linked home loan rates are almost effectively back to levels last seen in March or April 2014," said Mr Lim.

But fixed deposit-linked rates are not about to lose out. All three local banks have lowered the spreads for these rates in order to remain competitive, noted Mr David Baey Ee-Qiang, head of mortgage at personal finance comparison portal MoneySmart.sg.

OCBC Bank started offering from the middle of last month a home loan linked to its 36-month fixed deposit interest rate - now at 0.65 per cent - with a margin of 0.86 per cent in the first year, which works out to 1.51 per cent.

Its one-month Sibor home loan works out to about 1.14 per cent in the first year, although this rises to 1.33 per cent in the second year and 1.43 per cent in the third year. Fixed deposit-linked rates were especially popular in the past two years amid fears over rising interest rates, although experts believe most people are on Sibor loans.

While those who took up fixed deposit-linked rates are technically on the losing end, these will be better if Sibor rises again, said Mr Baey. "It's basically a trade-off, whether you want the volatility of 1-month Sibor for very low rates or the stability of fixed deposit-linked for slightly higher rates." Ms Tok Geok Peng, DBS Bank executive director of secured lending, said she advises her customers to "opt for certainty in their monthly repayments, instead of trying to gain from market interest rate volatility which could be short-term and cyclical".

As with OCBC, DBS is offering special National Day rates. DBS' rate is pegged to its 18-month fixed deposit interest rate with a margin of 0.4 per cent for the first year, which works out to about 1 per cent. So how long will low home loan rates last?

Traders forecast a 30.1 per cent probability that the US Fed will raise rates once by the end of this year, while the probability goes up to 34.7 per cent by next July, said Mr Hui. "Based on the latest outlook, it would seem likely that interest rates remain low till mid-2017."

The low rates are a boon for office administrator Janice Wong, 50, who has an outstanding home loan of about $700,000, with the rate just going up to over 2.1 per cent a few months back.

"Thankfully, with the ongoing current low rates, I was still able to refinance my home loan and managed to save about $11,000 over the next three years," she said.

Adapted from: The Business Times, 28 July 2016