US-China trade war: Moving to Vietnam to avoid sanctions

PropertyBoom.co DEMO

Last Updated on 08-Aug-2025

Companies operating in China are facing stiff increases in tariffs on exports to the United States as the trade war between the two countries escalates.

So, there's an incentive for manufacturers in China to move their production to countries not subject to these tariffs.

And one of these beneficiary countries has been Vietnam, China's increasingly business-friendly southern neighbour.

So what can we say about changing Chinese investment into Vietnam?

The first thing to note is that foreign firms, including those from China, have long taken advantage of Vietnam's cheaper labour and attractive business environment, well before the imposition of the first round of US sanctions last September.

"Vietnam has already been gaining as wages have been rising in China," says Mary Lovely at the Peterson Institute for International Economics, a US-based think tank.

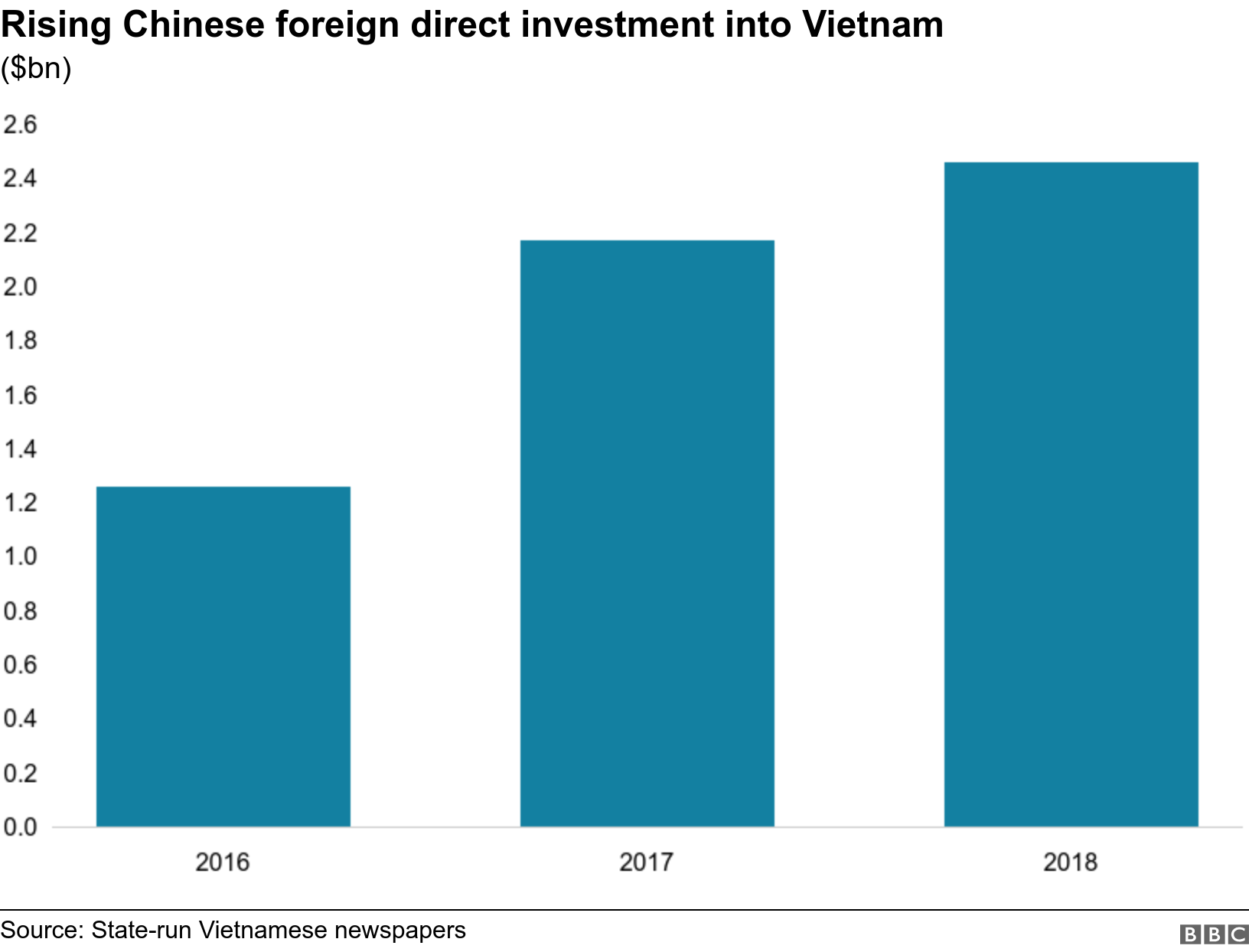

But there are also indications that investment has accelerated since the imposition of US sanctions on China last year.

In the first four months of 2019, Chinese investment into Vietnam has already reached about 65% of the total for 2018.

So there's certainly been an upsurge in Chinese investment, but how much of this is to do with tariffs?

Vietnam's success story

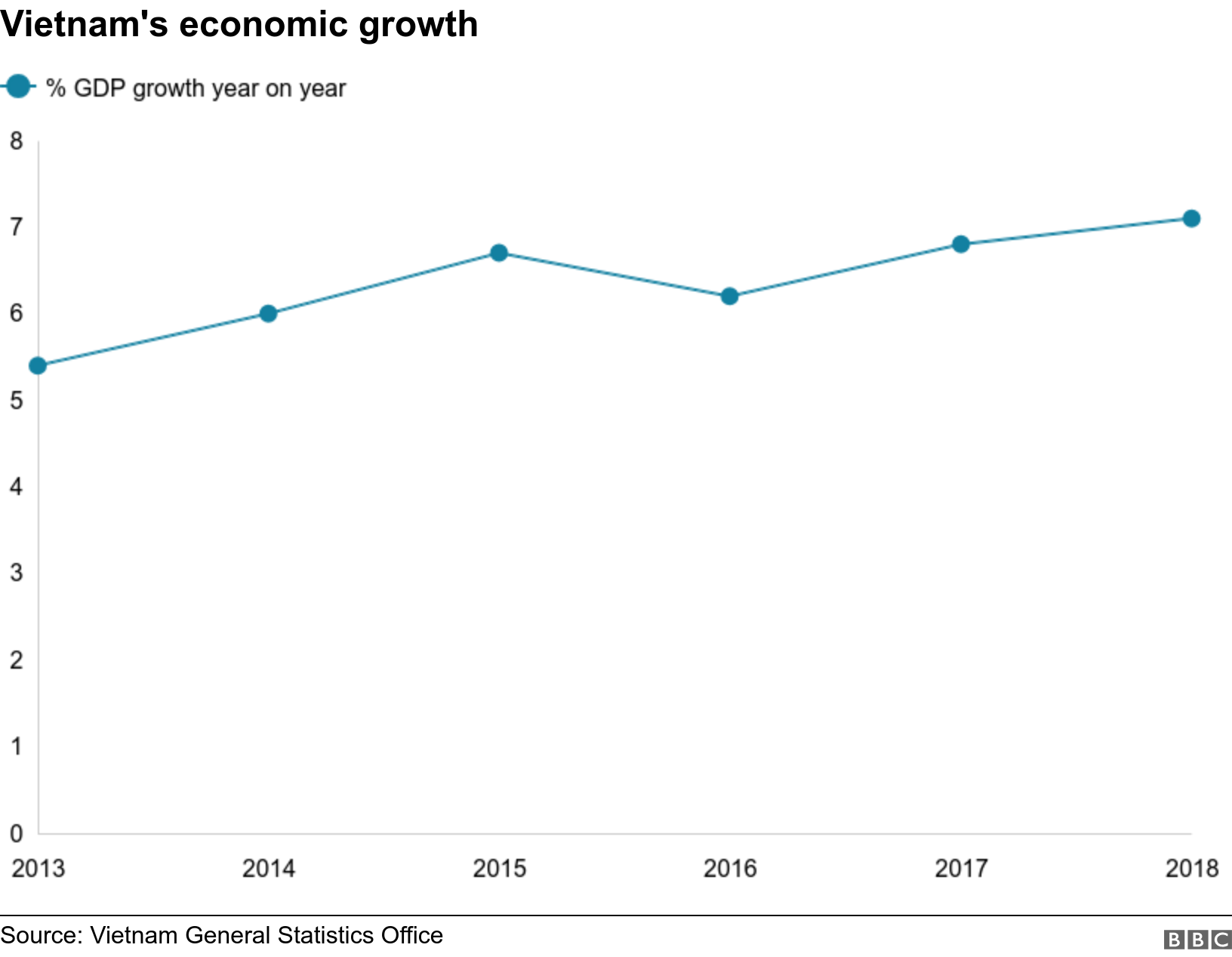

Vietnam's economy has grown rapidly in the past decade.

Its manufacturing industry has done particularly well, with multinationals like IKEA, for instance, bolstering operations there.

And while the growth of industry is a long-term trend, experts say there's growing evidence that an increasingly stringent US tariff regime on Chinese goods is driving further investment into Vietnam.

"Many companies were investing in production outside of China, particularly in South East Asia, before the current trade conflict", according to corporate law firm, Baker & McKenzie, based in Hong Kong, but "the recent trade friction has simply accelerated this evolution."

There are, however, clear signs that the pressures of rapid growth in Vietnam are taking their toll.

There were just over 14.5 million people in 2018 working in industry in Vietnam, according to the International Labour Organization.

That compares with more than 200 million in China.

Labour costs in Vietnam are rising, and the pool of new labour to draw on is much smaller than for its giant neighbour.

The ability for Vietnam to continue to absorb foreign investment will also be constrained by rising land and factory costs.

According to JLL Vietnam, a firm that specializes in real estate, industrial rental prices rose by 11% in the second half of 2018 in southern Vietnam. This has been attributed to the shift of producers from China, partly because of tariffs.

Sanctions against Vietnam?

For firms moving all or part of their supply chains from China to Vietnam to avoid US sanctions, there is a risk that the US could take action against Vietnam as well.

Some multinationals are taking on a "China plus one" approach - firms keeping a foothold in China while also operating in a low-wage economy elsewhere in Asia.

The US administration is aware of the shift into production operations outside China as a way to avoid sanctions.

President Trump recently tweeted: "Many Tariffed companies will be leaving China for Vietnam and other such countries in Asia. That's why China wants to make a deal so badly!"

In the escalating trade war between the United States and China, the label "Made in Vietnam" may not in the future be enough to avoid US tariffs.

Adapt From BBC News